Personal Loan Calculator - Calculatorall.com

This personal loan calculator can provide you with very concise visuals that will be helpful in determining monthly payments as well as total costs that you'll have to bear over the period of your personal loan. As there is some sort of fees and insurance costs associated with most of the loans, their end costs can turn out to be quite higher compared to simple calculations. The personal loan calculator here considers all the involved variables when it comes to determining real APR for your loan.

What Are Personal Loans?

In a broader sense, auto, mortgage, credit lines, and the credit cards can all be taken as personal loans. However, this personal loan calculator here is designed specifically for unsecured loans that are granted for any kind of personal use in major purchases like vacations, medical bills, or weddings. Some might even like to take a different approach and use the loan amount as an investment for their small business as well. Around fifty percent of all the personal loans are used for debt consolidation by the borrowers.

Traditionally, these loans were offered by credit unions, banks, and cash advance and pawn shops. Lately, some peer-to-peer lenders have also started showing up and playing their part in loan industry. The loans offered by them usually have better terms due to their low overhead site is not actually the lender but works as middleman that takes only a small amount for its assistance. These P2P lenders have really made things easier when it comes to connecting lenders and the borrowers who'd mutually benefit by doing business.

How Personal Loans Work?

These are the fixed amount loans that are offered at fixed interest rates. Also, the monthly payments are also fixed for a pre-defined period of time. Typically, the loan amounts are between $5000 and $35000 with a loan term of 3 years or 5 years. No collateral is there to back these loans as it is usually the case with secured loans. So, as they're unsecured loans, you can expect to pay higher interest rates that are there to balance the high risk lender has to take. You can expect to pay interest as high as 25 percent.

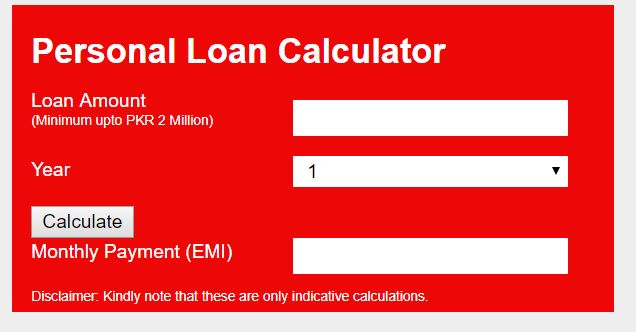

How This Personal Loan Calculator Works?

The personal loan calculator here requires you to enter some of the major values to find out how your personal loan repayments would look like over a period of time. Some of the key variables that you have to enter include the loan amount, rate of interest, any insurance amount per month, the loan term and its starting date. Besides, you have to tell the personal loan calculator whether you have paid the origination fees upfront or it has to be deducted from your loan amount. You also need to specify if the origination fee is a percentage of the loan amount or a fix amount regardless of what your loan amount may be.

Now, as you hit the calculate button, the personal loan calculator will give you calculations for monthly payments, monthly payments including insurance amount, total loan amount that you will be paying over the term of your loan, total of insurance amount, total interest that you'll have to pay, and the payoff date among a few others. Besides, there is a complete table for your month to month payments that shows your beginning and ending balance along with interest and principal amount each month.