APR Calculator - Calculatorall.com

When you apply for loans, the lenders commonly charge you some additional points or fees other than interest amount. These costs are considered by real annual percentage rate or APR along with the interest rate that applies to your loan. Here our APR calculator allows you to reveal true costs that you have to bear on your loans with the help of real APR.

General APR Calculator

Mortgage APR Calculator

What Is Real APR?

Real APR isn't same as your loan's interest rate which usually represents your borrowing cost on your principal amount. Though it is useful, the interest rates don't offer accuracy that you are looking for as a borrower in determining the rate offered by which lender would be your best bet. The real APR calculator helps you out by factoring in the rate of interest as well as other additional costs that you might have to bear with the loan. Most of the loans give wiggle room to the lenders for what they'd like to add to the APR.

When the fees are allocated, it's presumed that loan will run its due course. If the borrower plans on paying off the loan a lot quickly, APR usually underestimates the kind of impact created by upfront costs. The costs usually look a lot cheaper as they're spread over a long period rather than quickly accelerated repayment that you have to make within 10 years.

APR is used conventionally for measuring the costs of a loan, not the interest rates. The US law makes it mandatory for the lenders to show APRs so that the borrowers can be able to compare different options easily. Even though the lenders may come up with ‘no-fee’ loans sometimes, and for these the rate of interest should be same as APR in case of fixed rate.

Let's look at a list featuring some of the common fees which are packaged usually into the mortgage APRs. Obviously, all lenders are different and the fees mentioned here are some rough generalizations only. So, it is in your best interest to ask your lender to specify all the fees that will be packaged into the individual APRs.

. Administration fee . Courier fee

. Mortgage insurance . HOA Review and/or Transfer fee

. Application fee . Discount points

. Mortgage broker fee . Origination points

. Broker fee . PMI

. Audit Fee . Refinance fee

. Closing fee . Processing fee

. Escrow fee . Underwriting fee

The fees that normally exempt from the APRs include:

. Appraisal fee

. Prepaid items on the escrow balances, like taxes/insurance

. Builder Warranty

. Title inspection

. Intangible tax

There are basically two types of APRs i.e. fixed and variable. Both the options have their own merits and demerits.

Fixed APRs

The loans that have fixed APRs are offered at rates that do not change at all during loan's term. It's a good choice for borrowers who are getting a great fixed rate in times when the market is running relatively low and the rates are expected to increase later on. Fixed rates, however, tend to be higher as compared to variable rates when the loan is first originated.

Variable APRs

The loans that have variable APRs are offered at rates which might change any time. This change in interest rates is because of their correlation to some index. For example, if interest rates in the market increase, mostly the variable APRs associated with the loans go up as well. Another component related to the variable APRs is credit-based margin and the lenders actually create it. It refers to a portion of extended variable APR that is offered to potential borrowers and isn't determined by market index. Rather, it's the borrower's creditworthiness that determines this value.

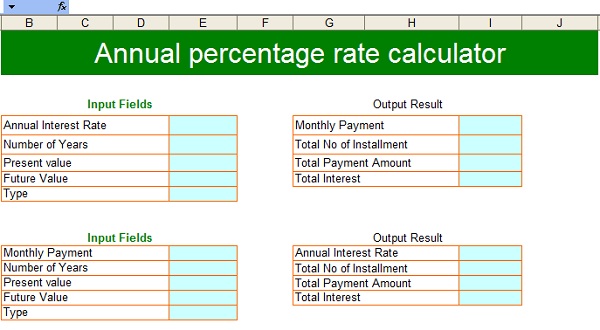

How This APR Calculator Works?

Here on this APR calculator page, you have two different APR calculator. The first is the general APR calculator that requires you to enter your loan amount, the loan term, rate of interest, pay back, compound, loaned fees and the upfront fees. As a result of the calculations performed by the calculator, you get the values for upfront out-of-pocket fees, yearly payment, total interest, total of the yearly payments that you'll be making over your loan's term, and all the fees and payments.

The second is the mortgage APR calculator and it is specifically designed for house mortgages. The calculator requires you to provide the value of your house, the percentage of down payment, your loan term, rate of interest, points, loan fees and PMI Insurance. As a result of the calculations, you get the values for the loan amount that will be given to you, the down payment you will have to make according to the given percentage, monthly payment, total of all the payments that you will be making over the term of your loan, total interest and all the fees and payments.

So, if you are interested in finding out any of these APR related values, you can use this APR calculator to get the desired results.